Ceramic Matrix Composite Aerospace Components in 2025: Unleashing Next-Gen Performance and Efficiency for the Aerospace Sector. Explore Market Dynamics, Technological Breakthroughs, and Strategic Forecasts Shaping the Future.

- Executive Summary: 2025 Market Highlights and Key Takeaways

- Industry Overview: Defining Ceramic Matrix Composite Aerospace Components

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Key Players and Competitive Landscape (e.g., ge.com, boeing.com, safran-group.com)

- Technological Innovations: Material Science and Manufacturing Advances

- Application Analysis: Engines, Airframes, and Thermal Protection Systems

- Supply Chain and Raw Material Trends

- Regulatory Environment and Industry Standards (e.g., sae.org, nasa.gov)

- Challenges and Barriers: Cost, Scalability, and Certification

- Future Outlook: Strategic Opportunities and Emerging Markets

- Sources & References

Executive Summary: 2025 Market Highlights and Key Takeaways

The market for ceramic matrix composite (CMC) aerospace components is poised for significant growth in 2025, driven by the aerospace sector’s ongoing demand for lightweight, high-performance materials. CMCs, known for their exceptional thermal resistance, low density, and superior mechanical properties, are increasingly being adopted in both commercial and defense aerospace applications. The year 2025 is expected to mark a pivotal period as major aerospace manufacturers accelerate the integration of CMCs into next-generation engines, airframes, and thermal protection systems.

Key industry players such as GE Aerospace, Safran, and Rolls-Royce are at the forefront of CMC innovation. GE Aerospace continues to expand the use of CMCs in its LEAP and GE9X engine programs, with CMC turbine shrouds and combustor liners now in serial production and operational use. Safran is similarly advancing CMC integration in its engine components, focusing on reducing weight and improving fuel efficiency. Rolls-Royce is investing in CMC research for future engine architectures, targeting both civil and military markets.

In 2025, the adoption of CMCs is expected to expand beyond engine hot section components to include structural and thermal protection applications. The U.S. National Aeronautics and Space Administration (NASA) is actively collaborating with industry partners to develop CMC-based heat shields and airframe parts for next-generation hypersonic vehicles and space exploration missions. Meanwhile, suppliers such as CoorsTek and 3M are scaling up production capabilities to meet rising demand from aerospace OEMs.

The outlook for the next few years indicates robust investment in CMC manufacturing infrastructure, with a focus on cost reduction, process automation, and supply chain resilience. The push for sustainable aviation and stricter emissions regulations are further accelerating the shift toward CMCs, as these materials enable lighter, more fuel-efficient aircraft. However, challenges remain in terms of high production costs and the need for further qualification and certification of CMC components for broader aerospace use.

In summary, 2025 will be a landmark year for CMC aerospace components, characterized by increased adoption, technological advancements, and strategic collaborations among leading manufacturers and research organizations. The sector is set to play a critical role in shaping the future of high-performance, sustainable aerospace systems.

Industry Overview: Defining Ceramic Matrix Composite Aerospace Components

Ceramic Matrix Composite (CMC) aerospace components represent a transformative class of materials engineered to meet the demanding requirements of modern aircraft and spacecraft. CMCs are composed of ceramic fibers embedded within a ceramic matrix, offering a unique combination of low density, high temperature resistance, and exceptional mechanical strength. These properties make CMCs particularly attractive for aerospace applications where weight reduction, fuel efficiency, and thermal stability are critical.

In 2025, the aerospace industry continues to accelerate the adoption of CMCs, especially in high-temperature environments such as turbine engines, exhaust systems, and thermal protection structures. The shift is driven by the need to improve engine efficiency and reduce emissions, as CMCs can withstand temperatures exceeding 1,300°C—significantly higher than conventional superalloys. This enables engine manufacturers to operate at higher temperatures, directly translating to better fuel economy and lower environmental impact.

Key industry players are heavily investing in the development and production of CMC components. GE Aerospace has pioneered the integration of CMCs in jet engine hot sections, notably in the LEAP and GE9X engines, where CMC turbine shrouds and nozzles contribute to weight savings and improved performance. Safran, in partnership with GE, is also advancing CMC technology for next-generation propulsion systems. Rolls-Royce is actively developing CMC components for future engine architectures, aiming to enhance thermal efficiency and durability.

On the supply side, companies such as CoorsTek and 3M are recognized for their expertise in advanced ceramics, supplying critical materials and components to aerospace OEMs. SGL Carbon and CeramTec are also notable for their CMC manufacturing capabilities, supporting both commercial and defense aerospace programs.

Looking ahead, the outlook for CMC aerospace components remains robust. The ongoing push for sustainable aviation, coupled with stricter emissions regulations and the pursuit of hypersonic flight, is expected to drive further innovation and adoption. As manufacturing processes mature and costs decrease, CMCs are likely to expand beyond engine components into airframe structures and space vehicles. The next few years will see intensified collaboration between material suppliers, OEMs, and research institutions to unlock the full potential of CMCs in aerospace applications.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The market for ceramic matrix composite (CMC) aerospace components is poised for robust growth between 2025 and 2030, driven by increasing demand for lightweight, high-performance materials in both commercial and defense aviation sectors. CMCs, known for their exceptional thermal resistance, low density, and superior mechanical properties, are increasingly being adopted in critical aerospace applications such as turbine engine components, exhaust systems, and structural parts.

Industry leaders such as GE Aerospace, Safran, and Rolls-Royce have made significant investments in the development and production of CMC components, particularly for next-generation jet engines. For example, GE Aerospace has integrated CMCs into its LEAP and GE9X engines, citing weight reductions of up to 1,000 pounds per aircraft and improved fuel efficiency. Similarly, Safran and Rolls-Royce are advancing CMC adoption in their engine programs to meet stringent emission and performance targets.

According to industry data and company forecasts, the global CMC aerospace components market is expected to achieve a compound annual growth rate (CAGR) in the range of 9% to 12% from 2025 to 2030. Revenue projections for the sector indicate that the market could surpass $3.5 billion by 2030, up from an estimated $2 billion in 2025. This growth is underpinned by increasing aircraft production rates, the introduction of new engine platforms, and the ongoing replacement of legacy metallic components with advanced CMC alternatives.

The commercial aviation segment is anticipated to account for the largest share of CMC demand, as airlines and manufacturers seek to improve fuel efficiency and reduce maintenance costs. Meanwhile, the defense sector is also expected to contribute significantly, with CMCs being specified for high-temperature applications in military jet engines and hypersonic vehicles. Key suppliers such as CoorsTek and 3M are expanding their CMC production capabilities to meet this rising demand.

Looking ahead, the outlook for CMC aerospace components remains highly positive, with ongoing research and development efforts focused on further improving material performance and reducing production costs. As regulatory pressures on emissions intensify and the aerospace industry continues to prioritize sustainability, the adoption of CMCs is expected to accelerate, solidifying their role as a critical enabler of next-generation aerospace technologies.

Key Players and Competitive Landscape (e.g., ge.com, boeing.com, safran-group.com)

The competitive landscape for ceramic matrix composite (CMC) aerospace components in 2025 is defined by a select group of major aerospace manufacturers, engine OEMs, and advanced materials specialists. These companies are driving innovation, scaling up production, and forming strategic partnerships to meet the growing demand for lightweight, high-temperature-resistant components in both commercial and defense aviation.

Among the most prominent players is GE Aerospace, which has pioneered the integration of CMCs into jet engine hot section components. GE’s LEAP and GE9X engines, used by leading airlines worldwide, feature CMC turbine shrouds and nozzles, enabling higher operating temperatures and improved fuel efficiency. In 2025, GE continues to expand its CMC manufacturing capacity in the United States, with investments in dedicated facilities and ongoing research into next-generation CMC formulations.

Another key player is Safran Group, a major supplier of aircraft engines and propulsion systems. Safran, through its joint venture with GE (CFM International), has been instrumental in deploying CMCs in the LEAP engine family. The company is also investing in proprietary CMC technologies for future engine programs, with a focus on scaling up production and improving component durability.

Boeing is actively collaborating with CMC suppliers and engine manufacturers to integrate these advanced materials into its next-generation commercial and defense platforms. Boeing’s focus is on leveraging CMCs for weight reduction and thermal management in critical airframe and propulsion applications, supporting its sustainability and performance goals.

In Europe, Airbus is working closely with engine partners and materials specialists to evaluate and implement CMCs in both commercial and military aircraft. Airbus is particularly interested in the potential of CMCs to contribute to its decarbonization roadmap by enabling more efficient engines and lighter structures.

Specialized materials companies such as CoorsTek and 3M are also significant contributors, supplying advanced ceramic fibers, matrices, and preforms to OEMs and Tier 1 suppliers. These firms are investing in R&D to enhance the performance and manufacturability of CMCs, supporting broader adoption across the aerospace sector.

Looking ahead, the competitive landscape is expected to intensify as demand for CMC components grows, driven by stricter emissions regulations and the push for more efficient aircraft. Strategic alliances, vertical integration, and continued investment in manufacturing scale and process automation will be key differentiators among leading players through the remainder of the decade.

Technological Innovations: Material Science and Manufacturing Advances

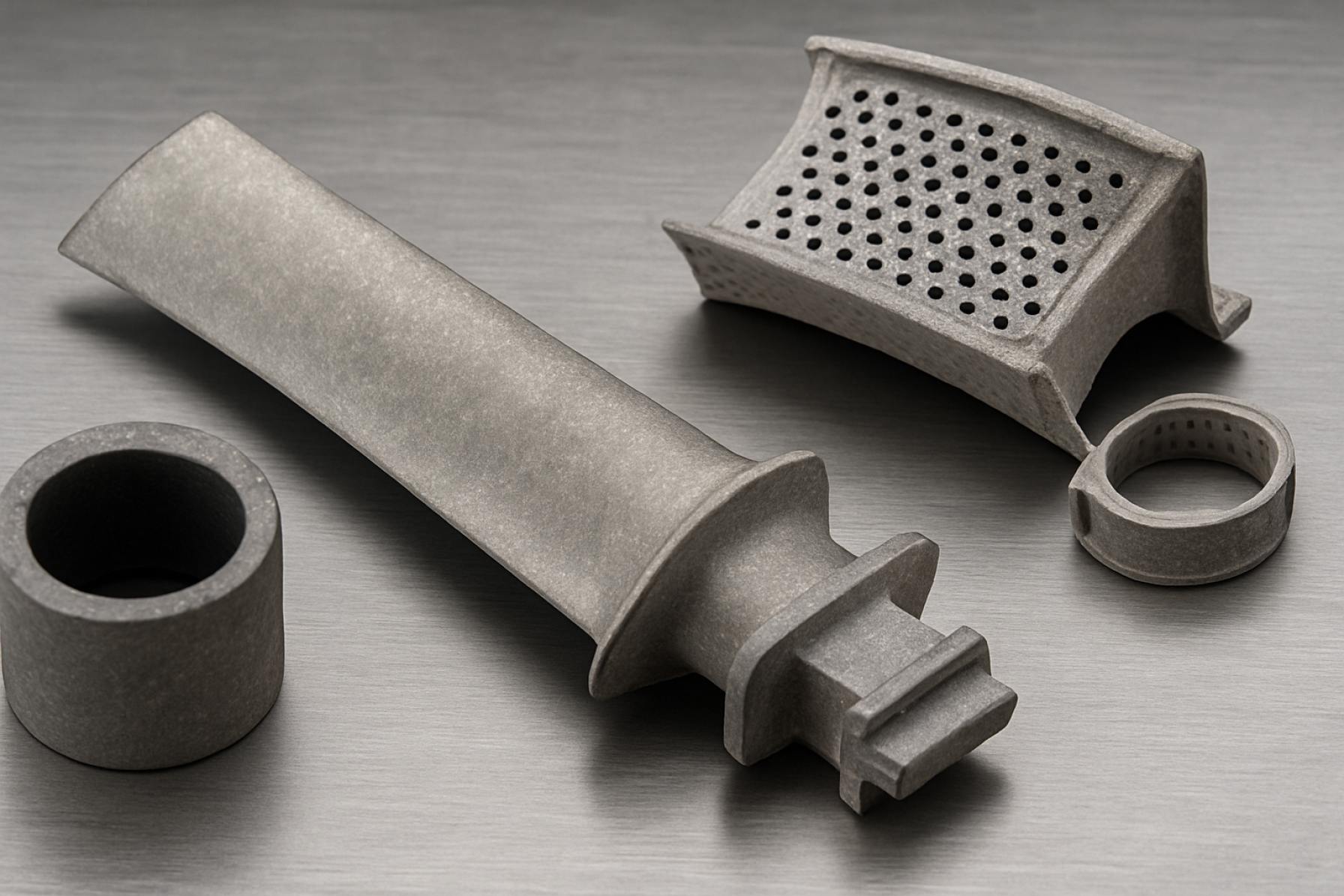

Ceramic Matrix Composites (CMCs) are at the forefront of aerospace material innovation, offering a unique combination of high-temperature resistance, low density, and superior mechanical properties compared to traditional superalloys. As of 2025, the aerospace sector is witnessing accelerated adoption of CMCs, particularly in engine components and thermal protection systems, driven by the demand for greater fuel efficiency and reduced emissions.

One of the most significant technological advances in recent years is the refinement of silicon carbide (SiC) fiber-reinforced CMCs. These materials are now being integrated into next-generation jet engines, notably in turbine shrouds, combustor liners, and nozzles. GE Aerospace has been a pioneer in this field, with its LEAP engine family featuring CMC turbine shrouds and nozzles, enabling higher operating temperatures and improved engine efficiency. The company’s ongoing investments in CMC manufacturing, including the expansion of its dedicated production facilities, underscore the strategic importance of these materials for future propulsion systems.

Similarly, Safran has advanced the use of CMCs in its engine programs, collaborating with partners to develop SiC-based components that can withstand temperatures exceeding 1300°C. These innovations are critical for meeting stringent environmental regulations and supporting the transition to more sustainable aviation.

On the manufacturing front, the industry is moving towards more scalable and cost-effective production methods. Automated fiber placement, advanced chemical vapor infiltration, and additive manufacturing techniques are being refined to increase yield and reduce cycle times. Rolls-Royce is actively developing CMC manufacturing capabilities, focusing on process automation and quality control to enable broader adoption in both civil and defense aerospace applications.

In addition to propulsion, CMCs are being evaluated for use in hypersonic vehicle structures and thermal protection systems, where their lightweight and thermal stability are essential. Organizations such as NASA are conducting extensive research into CMCs for reusable space vehicles, with recent test campaigns demonstrating promising durability and performance under extreme conditions.

Looking ahead, the next few years are expected to bring further breakthroughs in fiber architecture, matrix composition, and joining technologies, enabling even more complex and reliable CMC components. As aerospace OEMs and suppliers continue to invest in R&D and scale up production, CMCs are poised to become a cornerstone of advanced aerospace engineering, supporting the industry’s goals for efficiency, sustainability, and performance.

Application Analysis: Engines, Airframes, and Thermal Protection Systems

Ceramic Matrix Composites (CMCs) are increasingly pivotal in aerospace applications, particularly in engines, airframes, and thermal protection systems. Their unique combination of low density, high-temperature resistance, and superior mechanical properties compared to traditional superalloys is driving adoption across both commercial and defense sectors.

Engines: The most significant near-term application of CMCs is in aircraft engine components. CMCs, such as silicon carbide matrix composites, are being integrated into turbine shrouds, combustor liners, and nozzles. These materials enable higher operating temperatures, which directly translates to improved fuel efficiency and reduced emissions. GE Aerospace has been a leader in this domain, with its LEAP engine family featuring CMC turbine shrouds and nozzles. The company has announced plans to expand CMC use in its next-generation engines, including the CFM RISE program, targeting entry into service in the early 2030s but with significant development milestones expected by 2025. Safran, a key partner in CFM International, is also scaling up CMC production capacity to meet anticipated demand. Rolls-Royce is advancing CMC integration in its UltraFan demonstrator, with ongoing testing of CMC components in high-pressure turbine environments.

Airframes: While engine applications are more mature, CMCs are beginning to see use in airframe structures, particularly where weight savings and thermal resistance are critical. Boeing and Airbus are both evaluating CMCs for leading edges, control surfaces, and hot structures in next-generation aircraft. The focus for 2025 and beyond is on hybrid structures that combine CMCs with carbon fiber-reinforced polymers, aiming to optimize performance and manufacturability. The U.S. Department of Defense and NASA are also funding research into CMC airframe applications for hypersonic vehicles, where extreme thermal loads preclude the use of metals or conventional composites.

Thermal Protection Systems (TPS): CMCs are essential for TPS in both reusable space vehicles and hypersonic platforms. Northrop Grumman and Lockheed Martin are actively developing CMC-based TPS for next-generation reentry vehicles and missiles. NASA’s Artemis program is leveraging CMCs for heat shields and leading edges, with ongoing qualification of new materials for lunar and Mars missions. The outlook for 2025 includes further flight demonstrations and the scaling of CMC TPS for commercial space applications.

Overall, the next few years will see CMCs transition from niche to mainstream in aerospace, driven by engine efficiency mandates, hypersonic vehicle development, and the need for advanced thermal protection. Major OEMs and suppliers are investing in production scale-up and qualification, signaling robust growth and broader adoption across the sector.

Supply Chain and Raw Material Trends

The supply chain for ceramic matrix composite (CMC) aerospace components is undergoing significant transformation in 2025, driven by increasing demand for lightweight, high-temperature materials in both commercial and defense aviation. CMCs, typically composed of silicon carbide (SiC) fibers embedded in a ceramic matrix, are valued for their ability to withstand extreme environments, making them critical for next-generation jet engines, turbine blades, and thermal protection systems.

Key players in the CMC aerospace supply chain include major engine manufacturers such as GE Aerospace, Rolls-Royce, and Safran, all of which have invested heavily in CMC research, production, and integration. GE Aerospace continues to expand its CMC manufacturing capacity in the United States, with its dedicated CMC facility in North Carolina supporting the LEAP and GE9X engine programs. Rolls-Royce is advancing its CMC capabilities through partnerships and in-house development, focusing on high-temperature turbine applications. Safran collaborates with Messier-Bugatti-Dowty and other subsidiaries to integrate CMCs into landing gear and engine components.

Raw material sourcing remains a critical concern. The supply of high-purity silicon carbide fibers and precursor materials is dominated by a few specialized producers, such as Toray Industries and COI Ceramics. These companies are scaling up production to meet aerospace-grade quality and volume requirements, but the market remains tight, with lead times extending into 2026 for some grades. The reliance on a limited number of suppliers for SiC fibers and matrices introduces vulnerability to disruptions, prompting OEMs to seek diversification and vertical integration strategies.

In 2025, geopolitical factors and energy costs are impacting the CMC supply chain. The energy-intensive nature of CMC production, especially for SiC fiber synthesis and matrix densification, has led to increased operational costs. Companies are investing in process optimization and alternative energy sources to mitigate these pressures. Additionally, efforts to localize supply chains—particularly in the US and Europe—are accelerating, with new facilities and partnerships announced to reduce dependence on overseas suppliers.

Looking ahead, the outlook for CMC aerospace components is robust, with demand projected to grow as more engine platforms adopt these materials for improved fuel efficiency and emissions performance. However, the pace of adoption will be closely tied to the ability of the supply chain to deliver consistent quality and volume, as well as to manage raw material risks. Strategic investments by leading manufacturers and material suppliers are expected to shape the competitive landscape through 2027 and beyond.

Regulatory Environment and Industry Standards (e.g., sae.org, nasa.gov)

The regulatory environment for ceramic matrix composite (CMC) aerospace components is evolving rapidly as these advanced materials gain wider adoption in both commercial and defense aviation. In 2025, the focus remains on ensuring that CMCs meet stringent safety, reliability, and performance standards required for critical aerospace applications such as turbine engine parts, exhaust systems, and thermal protection structures.

Key industry standards for CMCs are developed and maintained by organizations such as the SAE International, which publishes specifications and recommended practices for testing, qualification, and certification of advanced composite materials. SAE’s Aerospace Material Specifications (AMS) series includes documents specifically addressing the unique properties and testing protocols for CMCs, covering aspects like mechanical strength, oxidation resistance, and high-temperature behavior. These standards are regularly updated to reflect advances in material science and manufacturing processes.

The National Aeronautics and Space Administration (NASA) plays a pivotal role in the regulatory landscape, particularly for space applications. NASA’s rigorous qualification procedures for CMCs are designed to ensure material integrity under extreme thermal and mechanical loads encountered during launch and re-entry. NASA collaborates with industry partners to develop and validate new CMC components, and its technical standards often serve as benchmarks for the broader aerospace sector.

In the United States, the Federal Aviation Administration (FAA) is responsible for certifying aircraft components, including those made from CMCs. The FAA requires comprehensive data on material performance, manufacturing consistency, and in-service durability before granting approval for use in commercial aircraft. As CMCs are increasingly used in next-generation engines and airframes, the FAA is working closely with manufacturers to adapt certification pathways and address the unique challenges posed by these materials.

Looking ahead, the regulatory environment is expected to become more harmonized internationally, with organizations such as the European Union Aviation Safety Agency (EASA) aligning their standards with those of the FAA and SAE. This harmonization will facilitate the global adoption of CMC components and streamline the certification process for multinational aerospace programs. As the industry continues to push the boundaries of material performance, ongoing collaboration between regulatory bodies, standards organizations, and leading manufacturers will be essential to ensure the safe and reliable integration of CMCs into future aerospace platforms.

Challenges and Barriers: Cost, Scalability, and Certification

Ceramic Matrix Composites (CMCs) have emerged as a transformative material class for aerospace components, offering significant advantages in weight reduction, thermal resistance, and durability. However, as of 2025, the widespread adoption of CMCs in aerospace faces persistent challenges related to cost, scalability, and certification.

Cost remains a primary barrier. The production of CMCs involves complex processes such as chemical vapor infiltration and high-temperature sintering, which are both energy-intensive and time-consuming. The raw materials—often silicon carbide or alumina fibers—are expensive, and the yield rates for defect-free components are still lower than for traditional alloys. Leading aerospace manufacturers such as GE Aerospace and Safran have invested heavily in CMC research and production facilities, but even with increased automation and process optimization, CMC components can cost up to ten times more than their nickel-based superalloy counterparts. This cost premium restricts CMC use primarily to high-value applications, such as turbine shrouds and combustor liners in next-generation jet engines.

Scalability is another significant hurdle. While companies like GE Aerospace have established dedicated CMC manufacturing plants in the United States, and Safran has expanded its CMC capabilities in Europe, global production capacity remains limited. The intricate manufacturing steps, including fiber weaving, matrix infiltration, and precise machining, are difficult to scale without compromising quality. As demand for fuel-efficient engines grows, especially with the push for sustainable aviation, the industry faces pressure to ramp up CMC output. However, supply chain constraints—such as limited suppliers of high-purity ceramic fibers—pose ongoing risks to scalability.

Certification presents a further barrier to widespread CMC adoption. Aerospace components must meet rigorous safety and reliability standards set by regulatory bodies such as the FAA and EASA. The long-term behavior of CMCs under cyclic thermal and mechanical loads is still being characterized, and the lack of extensive field data slows the certification process. Companies like GE Aerospace and Safran are collaborating with airframe and engine OEMs to conduct extensive ground and flight testing, but the path to full certification for critical rotating parts remains cautious and incremental.

Looking ahead, the next few years are expected to see incremental progress as manufacturers invest in process innovation, supply chain development, and collaborative certification efforts. However, unless breakthroughs in cost reduction and scalable manufacturing are achieved, CMCs will likely remain reserved for select, high-performance aerospace applications through the latter half of the 2020s.

Future Outlook: Strategic Opportunities and Emerging Markets

The outlook for ceramic matrix composite (CMC) aerospace components in 2025 and the following years is marked by robust strategic opportunities and the emergence of new markets, driven by the aerospace sector’s ongoing demand for lightweight, high-performance materials. CMCs, known for their exceptional thermal resistance, low density, and durability, are increasingly being adopted in both commercial and defense aerospace applications, particularly in engine hot sections, exhaust systems, and structural components.

Major aerospace engine manufacturers are at the forefront of CMC integration. GE Aerospace has been a pioneer, incorporating CMCs into its LEAP and GE9X engines, with ongoing plans to expand CMC usage in next-generation propulsion systems. The company’s investment in dedicated CMC manufacturing facilities underscores its commitment to scaling up production and reducing costs, aiming to meet the growing demand from both commercial and military aviation sectors. Similarly, Safran is advancing CMC adoption through its partnership with GE in CFM International, focusing on the LEAP engine family and exploring further applications in future engine programs.

On the airframe side, Airbus and Boeing are evaluating CMCs for high-temperature and weight-critical components, with research and pilot projects underway to validate performance and manufacturability. The push for more fuel-efficient and environmentally friendly aircraft is expected to accelerate CMC adoption, as these materials contribute to lower fuel consumption and reduced emissions.

Emerging markets in Asia and the Middle East are also presenting new opportunities. Companies such as COMAC in China are investing in advanced materials for their next-generation aircraft, while regional engine and component suppliers are beginning to establish CMC production capabilities. This geographic diversification is likely to drive global competition and innovation in the sector.

Looking ahead, the CMC aerospace component market is poised for significant growth through 2030, with strategic opportunities centered on:

- Expanding CMC use in commercial and military engines, including hypersonic and space propulsion systems.

- Developing cost-effective manufacturing processes to enable broader adoption beyond premium applications.

- Collaborations between OEMs, material suppliers, and research institutions to accelerate technology readiness and certification.

- Addressing supply chain resilience and scaling up production to meet anticipated demand surges.

As the aerospace industry intensifies its focus on sustainability and performance, CMCs are set to play a pivotal role in shaping the next generation of aircraft and propulsion systems, with leading companies and emerging players alike investing heavily in this transformative technology.

Sources & References

- GE Aerospace

- Rolls-Royce

- NASA

- SGL Carbon

- CeramTec

- Boeing

- Airbus

- Northrop Grumman

- Lockheed Martin

- Toray Industries

- COI Ceramics

- European Union Aviation Safety Agency (EASA)