2025 Platinum Group Element Catalysis for Fuel Cell Technologies: Market Dynamics, Innovation Trends, and Strategic Forecasts. Explore Key Drivers, Regional Growth, and Competitive Insights Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Platinum Group Element Catalysis

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR and Revenue Projections

- Regional Analysis: Demand, Supply, and Investment Hotspots

- Challenges and Opportunities in PGE Catalysis for Fuel Cells

- Future Outlook: Innovation Pathways and Strategic Recommendations

- Sources & References

Executive Summary & Market Overview

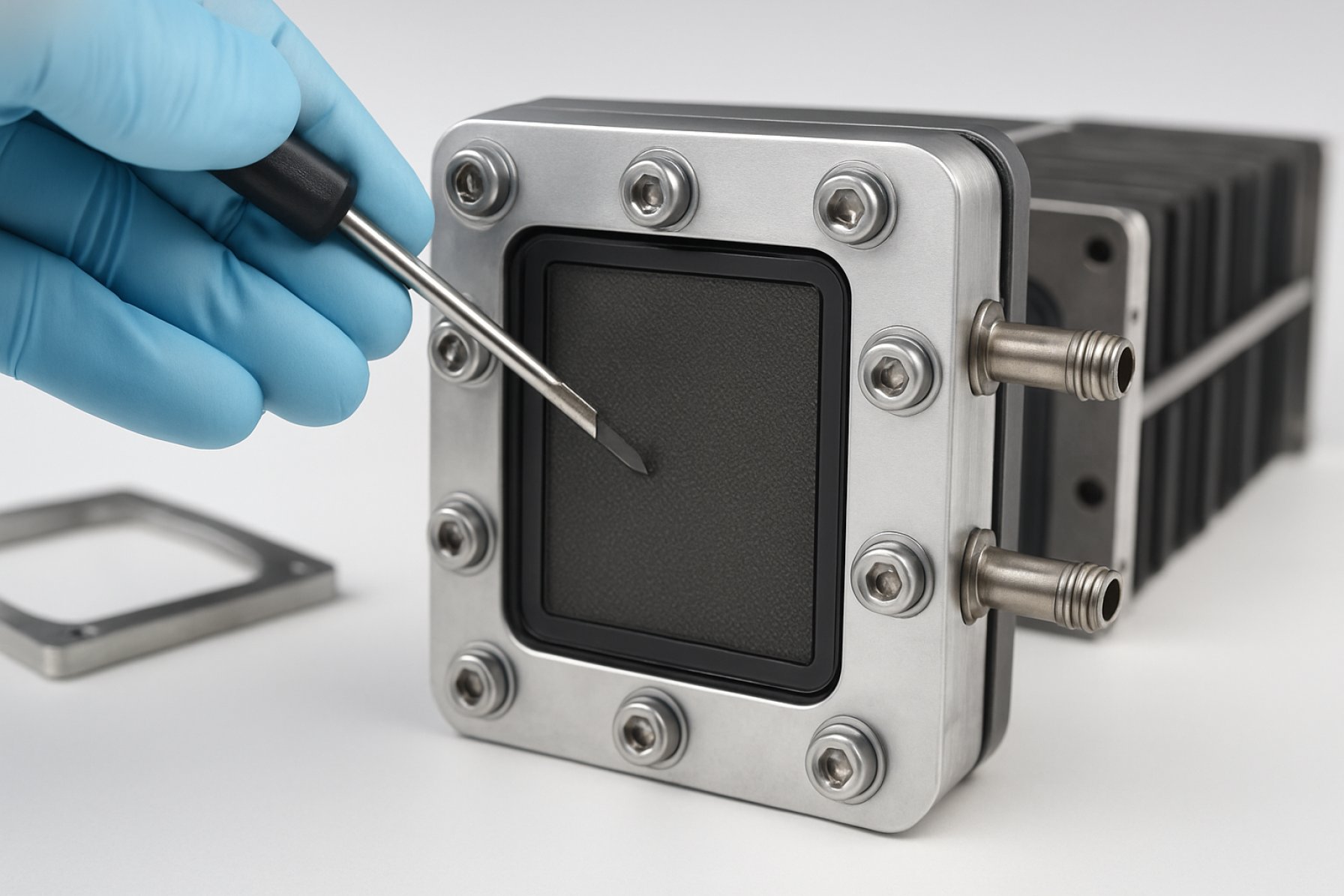

The global market for platinum group element (PGE) catalysis in fuel cell technologies is poised for significant growth in 2025, driven by accelerating demand for clean energy solutions and the ongoing transition toward decarbonization. Platinum group elements—primarily platinum, palladium, and rhodium—are critical components in fuel cell catalysts due to their exceptional activity, stability, and selectivity in facilitating electrochemical reactions, particularly in proton exchange membrane (PEM) and solid oxide fuel cells.

Fuel cell technologies are gaining traction across multiple sectors, including automotive, stationary power generation, and portable electronics. The automotive sector, in particular, is a major driver, with leading manufacturers such as Toyota Motor Corporation and Hyundai Motor Company expanding their fuel cell electric vehicle (FCEV) portfolios. According to International Energy Agency projections, global FCEV stock is expected to surpass 60,000 units by the end of 2025, up from approximately 40,000 in 2023, underscoring the rising demand for PGE-based catalysts.

The market is also influenced by government policies and incentives promoting hydrogen infrastructure and fuel cell adoption. The European Union’s Hydrogen Strategy and the U.S. Department of Energy’s Hydrogen Shot initiative are catalyzing investments in fuel cell R&D and deployment, further boosting demand for PGE catalysts (European Commission, U.S. Department of Energy).

However, the market faces challenges related to the high cost and supply constraints of PGEs, which are predominantly mined in South Africa and Russia. This has spurred innovation in catalyst design, including efforts to reduce PGE loading and develop recycling technologies. Companies such as Johnson Matthey and Umicore are at the forefront of these advancements, focusing on next-generation catalysts with improved performance and lower PGE content.

In summary, the PGE catalysis market for fuel cell technologies in 2025 is characterized by robust growth prospects, driven by expanding applications, supportive policy frameworks, and ongoing technological innovation. Nevertheless, supply chain vulnerabilities and cost pressures remain key considerations shaping the competitive landscape and future market dynamics.

Key Technology Trends in Platinum Group Element Catalysis

Platinum group elements (PGEs)—notably platinum, palladium, and rhodium—are at the forefront of catalysis for fuel cell technologies, underpinning advancements in both proton exchange membrane fuel cells (PEMFCs) and solid oxide fuel cells (SOFCs). In 2025, several key technology trends are shaping the landscape of PGE catalysis for fuel cells, driven by the dual imperatives of cost reduction and performance enhancement.

- Nanostructured and Alloy Catalysts: The development of nanostructured PGE catalysts, including core-shell and alloyed nanoparticles, is a major trend. These materials maximize the surface area-to-volume ratio, enhancing catalytic activity while reducing the overall PGE loading. For example, platinum-nickel and platinum-cobalt alloys have demonstrated improved oxygen reduction reaction (ORR) kinetics and durability in PEMFCs, as highlighted by Nature Energy.

- Single-Atom Catalysts (SACs): SACs, where individual PGE atoms are dispersed on conductive supports, are gaining traction due to their exceptional atom utilization efficiency. This approach significantly lowers the amount of precious metal required without compromising catalytic performance, as reported by Nano Energy.

- Durability and Poisoning Resistance: Enhancing catalyst durability and resistance to poisoning (e.g., by CO or sulfur compounds) remains a priority. Innovations in support materials, such as doped carbon and conductive ceramics, are helping to stabilize PGE nanoparticles and mitigate degradation, according to U.S. Department of Energy.

- Recycling and Circular Economy Initiatives: With PGEs being both scarce and expensive, recycling spent catalysts and developing closed-loop supply chains are increasingly important. Companies like Umicore are investing in advanced recycling technologies to recover PGEs from end-of-life fuel cells and automotive catalysts.

- Integration with Green Hydrogen: The synergy between PGE catalysts and green hydrogen production is accelerating. As electrolyzer and fuel cell markets expand, demand for high-performance PGE catalysts is rising, with S&P Global projecting robust growth in PGE consumption for clean energy applications.

These trends collectively reflect a dynamic innovation ecosystem, where advances in PGE catalysis are pivotal to the commercialization and scalability of next-generation fuel cell technologies in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for platinum group element (PGE) catalysis in fuel cell technologies is characterized by a concentrated group of global players, ongoing innovation, and strategic partnerships across the value chain. As of 2025, the market is dominated by a handful of established chemical and materials companies with vertically integrated operations, robust R&D capabilities, and strong supply chain networks.

Key industry leaders include Johnson Matthey, Umicore, and BASF, all of which have made significant investments in PGE catalyst development for proton exchange membrane (PEM) and solid oxide fuel cells. These companies leverage proprietary catalyst formulations and advanced manufacturing processes to enhance catalyst durability, reduce PGE loading, and improve overall fuel cell efficiency. Johnson Matthey remains a market leader, benefiting from its extensive patent portfolio and long-standing relationships with automotive OEMs and fuel cell system integrators.

Emerging players and startups are also making inroads, particularly in the development of next-generation catalysts that minimize or substitute PGEs. Companies such as Precious Metals Precursor and Avantium are exploring novel alloy compositions and nanostructured catalysts to address cost and supply chain concerns. These innovations are often supported by collaborations with academic institutions and government-funded research initiatives, such as those led by the ARPA-E and the U.S. Department of Energy’s Hydrogen and Fuel Cell Technologies Office.

- Strategic Partnerships: Leading players are increasingly forming alliances with automakers (e.g., Toyota, Hyundai) and energy companies to secure long-term supply agreements and accelerate commercialization.

- Geographic Concentration: Europe and Asia-Pacific remain the primary hubs for PGE catalyst production and fuel cell deployment, with significant investments in hydrogen infrastructure and clean mobility.

- Supply Chain Dynamics: The market is sensitive to fluctuations in PGE prices and geopolitical risks, prompting leading players to invest in recycling technologies and secondary sourcing strategies.

Overall, the competitive landscape in 2025 is defined by technological differentiation, supply chain resilience, and a growing emphasis on sustainability, as companies race to meet the rising demand for fuel cell technologies in transportation, stationary power, and industrial applications.

Market Growth Forecasts (2025–2030): CAGR and Revenue Projections

The market for platinum group element (PGE) catalysis in fuel cell technologies is poised for robust growth between 2025 and 2030, driven by accelerating adoption of clean energy solutions and increasing investments in hydrogen infrastructure. According to projections by MarketsandMarkets, the global fuel cell market is expected to register a compound annual growth rate (CAGR) of approximately 20% during this period, with PGE catalysts—primarily platinum, palladium, and rhodium—remaining critical to proton exchange membrane (PEM) and solid oxide fuel cell (SOFC) performance.

Revenue generated from PGE catalysis in fuel cell applications is forecast to reach $3.2 billion by 2030, up from an estimated $1.1 billion in 2025. This growth is underpinned by several factors:

- Automotive Sector Expansion: The commercialization of fuel cell electric vehicles (FCEVs) by major automakers such as Toyota Motor Corporation and Hyundai Motor Company is expected to drive significant demand for PGE catalysts, as these vehicles rely on PEM fuel cells with high platinum loadings.

- Stationary Power and Backup Systems: Increasing deployment of fuel cell systems for distributed power generation and backup applications, particularly in Asia-Pacific and Europe, will further boost PGE catalyst consumption, as noted by IDTechEx.

- Hydrogen Economy Initiatives: National hydrogen strategies in countries such as Japan, South Korea, Germany, and the United States are catalyzing investments in fuel cell infrastructure, with direct implications for PGE demand, according to International Energy Agency (IEA) analysis.

Despite ongoing research into PGE-free and low-PGE catalyst alternatives, the high activity, durability, and selectivity of platinum group elements ensure their continued dominance in fuel cell catalysis through 2030. However, supply chain constraints and price volatility for PGEs remain key risks that could impact market growth rates and revenue projections. Overall, the sector is expected to maintain a strong upward trajectory, with innovation in catalyst recycling and efficiency further supporting market expansion.

Regional Analysis: Demand, Supply, and Investment Hotspots

The regional landscape for platinum group element (PGE) catalysis in fuel cell technologies is shaped by a confluence of demand drivers, supply chain dynamics, and targeted investment flows. In 2025, Asia-Pacific, North America, and Europe emerge as the principal regions influencing the market trajectory, each with distinct characteristics.

Asia-Pacific continues to dominate demand, propelled by aggressive fuel cell vehicle (FCV) deployment targets in China, Japan, and South Korea. China’s “Hydrogen Energy Industry Development Plan (2021-2035)” and Japan’s “Strategic Roadmap for Hydrogen and Fuel Cells” are catalyzing large-scale adoption of proton exchange membrane (PEM) fuel cells, which rely heavily on platinum and other PGEs as catalysts. The region’s robust manufacturing ecosystem and government incentives have attracted significant investments from both domestic and international players, including Toyota Motor Corporation and Hyundai Motor Company, who are scaling up FCV production and infrastructure.

Europe is characterized by a strong policy push for decarbonization and green hydrogen, with the European Union’s “Fit for 55” package and the “Hydrogen Strategy for a Climate-Neutral Europe” driving demand for PGE-based fuel cell systems in transportation and stationary power. Germany, France, and the UK are leading investment hotspots, with public-private partnerships and funding from entities such as the Fuel Cells and Hydrogen Joint Undertaking (FCH JU) accelerating R&D and commercialization. European automakers and industrial gas companies, including Air Liquide and Siemens Energy, are investing in supply chain localization to mitigate risks associated with PGE sourcing.

- North America is witnessing renewed momentum, particularly in the United States and Canada, where the Inflation Reduction Act and clean energy tax credits are spurring investments in hydrogen infrastructure and fuel cell manufacturing. Companies like Ballard Power Systems and Plug Power are expanding production capacities, while collaborations with mining firms aim to secure PGE supply from North American sources.

Supply-side constraints remain a concern, as PGEs are predominantly mined in South Africa and Russia, regions subject to geopolitical and operational risks. This has prompted strategic investments in recycling and alternative catalyst research, particularly in Europe and North America, to ensure long-term supply security and cost stability for fuel cell technologies.

Challenges and Opportunities in PGE Catalysis for Fuel Cells

Platinum group elements (PGEs)—notably platinum, palladium, and rhodium—are central to the catalysis processes underpinning modern fuel cell technologies. As the global push for decarbonization intensifies, fuel cells are increasingly viewed as a cornerstone for clean energy systems, particularly in transportation and stationary power applications. However, the deployment of PGE-based catalysts in fuel cells faces a complex landscape of challenges and opportunities as of 2025.

Challenges

- Supply Constraints and Price Volatility: PGEs are rare, geographically concentrated (primarily in South Africa and Russia), and subject to significant price fluctuations. In 2024, platinum prices surged due to supply disruptions and increased demand from the automotive and hydrogen sectors, raising concerns about long-term availability and cost stability for fuel cell manufacturers (Anglo American Platinum).

- High Material Costs: The high intrinsic value of PGEs remains a major barrier to the widespread commercialization of fuel cell vehicles and stationary systems. Catalyst costs can account for up to 40% of the total fuel cell stack cost, impeding competitiveness with battery and combustion alternatives (International Energy Agency).

- Durability and Degradation: PGE catalysts are susceptible to poisoning (e.g., by CO), sintering, and dissolution under real-world operating conditions, which can reduce fuel cell efficiency and lifespan. Addressing these degradation mechanisms is critical for achieving the reliability required for mass-market adoption (National Renewable Energy Laboratory).

Opportunities

- Technological Innovation: Advances in catalyst design—such as alloying PGEs with base metals, developing core-shell structures, and utilizing nanostructured supports—are enabling significant reductions in PGE loading while maintaining or enhancing catalytic performance. These innovations are being rapidly commercialized, with several automakers and suppliers reporting PGE reductions of 50% or more in next-generation fuel cell stacks (Toyota Motor Corporation).

- Recycling and Circular Economy: The development of efficient recycling processes for spent fuel cell catalysts is emerging as a key strategy to mitigate supply risks and reduce lifecycle costs. Major PGE refiners are investing in closed-loop systems to recover and reuse PGEs from end-of-life fuel cells (Johnson Matthey).

- Policy and Market Growth: Government incentives, emissions regulations, and hydrogen economy roadmaps are accelerating investment in fuel cell infrastructure and R&D, creating a favorable environment for PGE catalyst innovation and scale-up (European Commission).

Future Outlook: Innovation Pathways and Strategic Recommendations

The future outlook for platinum group element (PGE) catalysis in fuel cell technologies is shaped by a dynamic interplay of innovation, supply chain considerations, and evolving market demands. As the global push for decarbonization intensifies, fuel cells—particularly proton exchange membrane (PEM) and solid oxide fuel cells (SOFCs)—are poised for significant growth, with PGEs such as platinum, palladium, and rhodium remaining central to their catalytic performance. However, the high cost and supply risk associated with these critical materials are driving both incremental and disruptive innovation pathways.

Key innovation trends include the development of PGE alloy catalysts, core-shell nanostructures, and atomically dispersed single-atom catalysts, all aimed at maximizing catalytic efficiency while minimizing PGE loading. For instance, research funded by the U.S. Department of Energy has demonstrated that platinum-alloy catalysts can reduce platinum usage by up to 50% without compromising performance, a critical step toward cost parity with incumbent technologies. Additionally, advances in catalyst support materials—such as doped carbon and conductive ceramics—are enhancing durability and resistance to poisoning, further extending catalyst lifetimes.

Strategically, leading fuel cell manufacturers and automotive OEMs are investing in closed-loop recycling systems to recover PGEs from end-of-life catalysts, mitigating supply risks and supporting circular economy objectives. Companies like Johnson Matthey and Umicore are at the forefront of these efforts, leveraging their expertise in both catalyst production and precious metal refining.

- Recommendation 1: Accelerate R&D investment in low-PGE and PGE-free catalyst technologies, leveraging public-private partnerships to de-risk scale-up and commercialization.

- Recommendation 2: Strengthen supply chain resilience through strategic sourcing, recycling, and collaboration with mining companies such as Anglo American Platinum and Impala Platinum Holdings.

- Recommendation 3: Foster standardization and certification of recycled PGE materials to ensure quality and traceability, supporting broader adoption in fuel cell applications.

- Recommendation 4: Monitor regulatory developments and incentives in key markets (e.g., EU, China, U.S.) that could accelerate fuel cell deployment and influence PGE demand dynamics.

In summary, the pathway to sustainable and scalable PGE catalysis for fuel cell technologies in 2025 hinges on a dual focus: technological innovation to reduce PGE dependency and strategic actions to secure and optimize PGE supply. Stakeholders who proactively address these dimensions will be best positioned to capitalize on the accelerating transition to hydrogen and fuel cell-based energy systems.

Sources & References

- Toyota Motor Corporation

- Hyundai Motor Company

- International Energy Agency

- European Commission

- Johnson Matthey

- Umicore

- Nature Energy

- BASF

- Precious Metals Precursor

- ARPA-E

- MarketsandMarkets

- IDTechEx

- Toyota Motor Corporation

- Air Liquide

- Siemens Energy

- Ballard Power Systems

- Anglo American Platinum

- National Renewable Energy Laboratory

- Impala Platinum Holdings